Update [December 2026]

Following the publication of a new Royal Decree-Law in the Official State Gazette, the Government has approved a further postponement of the mandatory implementation of VeriFactu.

The new official deadlines are as follows:

- Companies (Art. 3.1.a): mandatory as of January 1, 2027

- Self-employed workers and other obligated parties (Art. 3.1): mandatory as of July 1, 2027

This change extends the adaptation period by one year beyond what was initially indicated in this article.

In any case, Roomdoo has been fully compatible with VeriFactu for months. When you decide to activate it, we can easily do so in a quick video call without interrupting hotel operations.

You can consult the official text here:

BOE – Royal Decree-Law with the new deferral

The Royal Decree 1007/2023published by the Ministry of Finance, establishes the technical requirements to be met by the Computerized Invoicing Systems (SIF) used by companies and self-employed workers in Spain.

In this article we explain what it means for your hotel, the key deadlines, the obligations you need to meet and how Roomdoo is already up and running with Veri*Factu fully automatically.

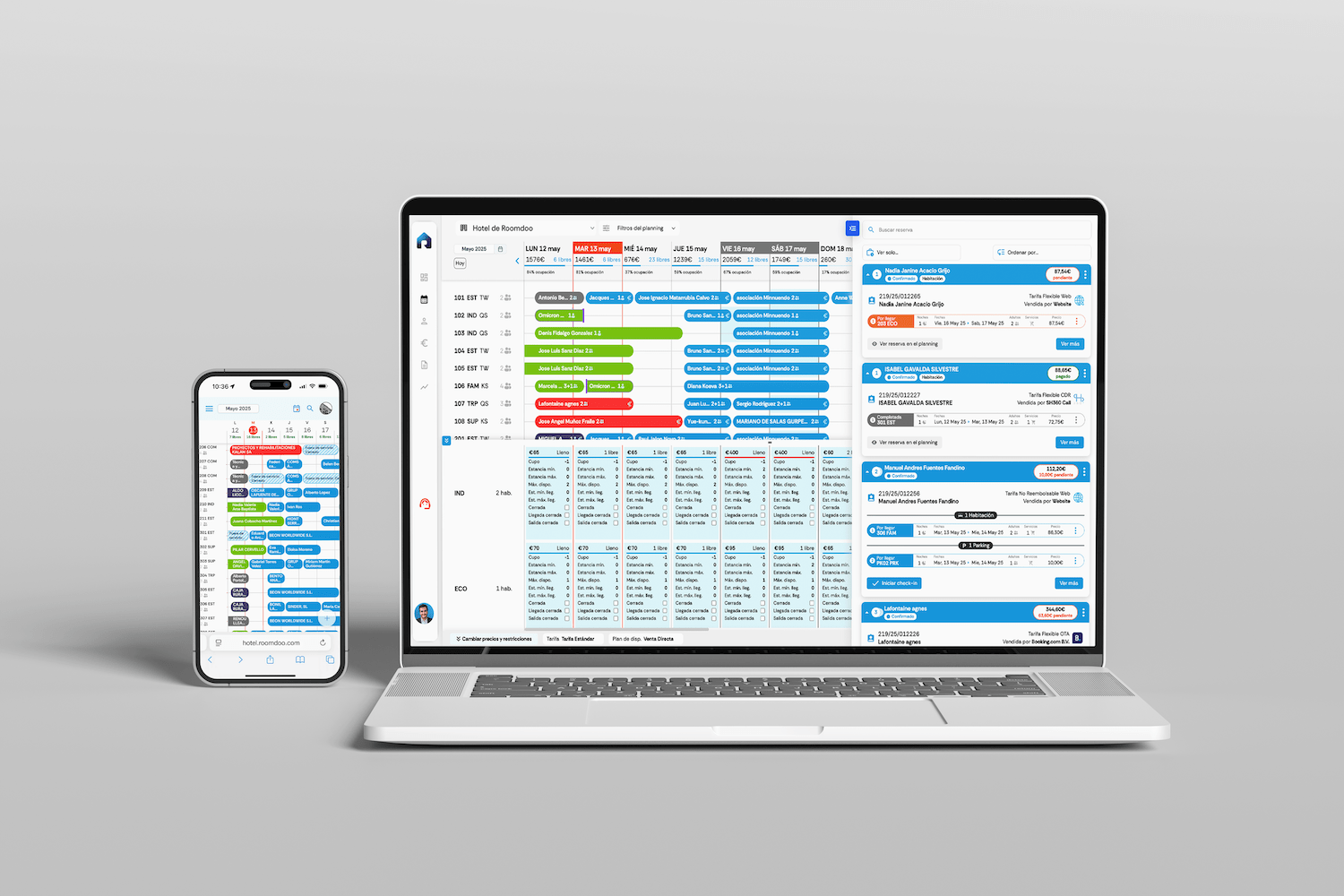

Roomdoo, the hotel vertical PMS based on Odoo ERP, we are already adapted to this regulation so that our customers can operate safely and smoothly. Roomdoo is built on Odoo, one of the most powerful and widely used management systems in the world. This allows us to natively integrate all tax requirements, including those of the VeriFactu system in an efficient way.

What is VERI*FACTU and why is it relevant for hotels?

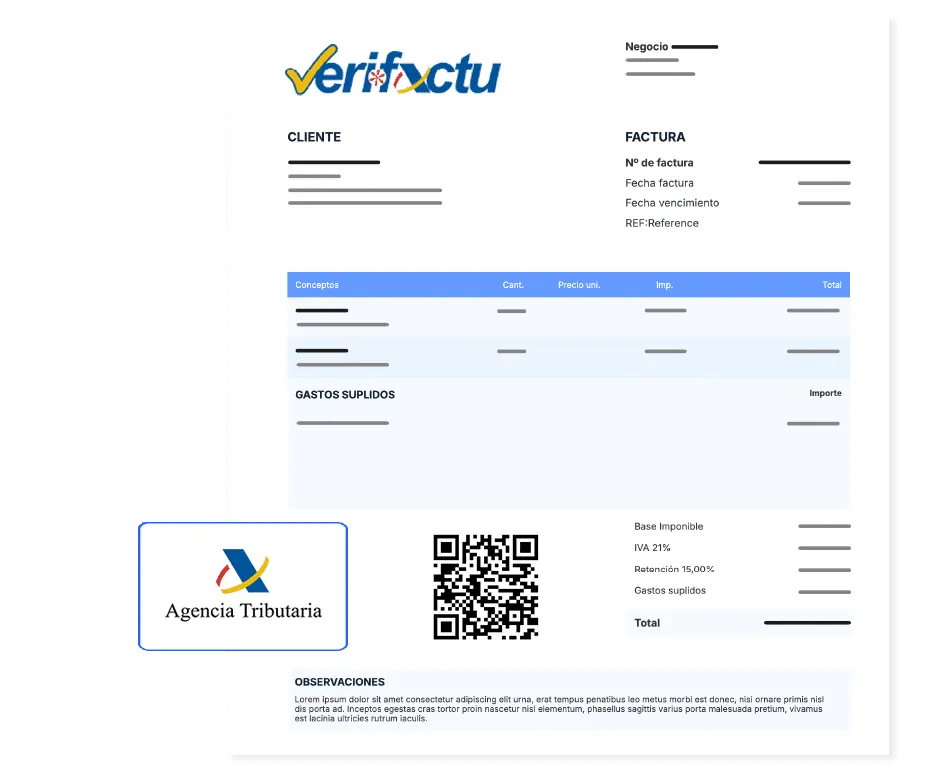

VERI*FACTU is the name of the system for issuing and storing verifiable invoices, which requires that each invoice or ticket issued by a company is digitally recorded, stamped and traced, so that it cannot be manipulated or deleted.

Its objective is to guarantee the integrity, conservation, traceability and accessibility of the invoicing information before the Tax Agency (AEAT). VeriFactu requires invoicing software:

- Generate an unalterable and digitally signed billing record.

- Incorporate a QR code and a unique identifier on each invoice.

- Apply a hash to ensure that the information has not been modified.

- Offer the option to automatically send records.

The objective is to eliminate the use of dual-use or manipulable software, ensuring that every invoice is recorded with full traceability.

How does VERI*FACTU affect hotels?

If you issue invoices with a PMS, this regulation affects you directly. All companies and freelancers (except in the Basque Country and Navarra) that use invoicing software must adapt. In the case of the tourism sector, this implies any accommodation.

Mandates that all billing programs - such as your hotel's PMS - generate unalterable records of each invoice, including a QR code, a unique identifier and a system that allows, if activated, to automatically send that data to the IRS.

Verifactu wants to avoid fraud with manipulated invoices, control the traceability of revenues and digitalize the accounting process.

This means that it will no longer be sufficient to issue invoices as before: your software will have to prove that each invoice is authentic, unique and unchanged.

VERI*FACTU deadlines

| Date | What happens? Obligation |

|---|---|

| July 29, 2025 | Invoicing software (SIF) must be adapted to VeriFactu. |

| January 1, 2026 | Compliance obligation for legal entities (companies). |

| July 1, 2026 | Compliance obligation for the self-employed. |

What does it mean for a hotel PMS?

In a hotel, the PMS (Property Management System) is responsible for issuing invoices, either after check-out, for reservations, or for additional services. If the system is not adapted to VeriFactu:

- It is illegal to install or upgrade since July 2025.

- You expose the hotel to financial penalties.

Therefore, it is essential that the PMS includes a certified billing layer and maintains continuous updates as regulations evolve.

Roomdoo the Odoo based PMS solution: PMS 100% compatible with VERI*FACTU

Roomdoo is built on top of Odoo, one of the most powerful and widely used ERP in the world. This allows us to natively integrate all fiscal requirements, including those of the VeriFactu system.

Specifically:

- We rely on the official development of OCA and Odoo to adapt the invoicing modules to VeriFactu.

- Our clients already have a system that generates unalterable records that can be exported to the tax authorities.

- You don't need external installations or to change software: everything is integrated into the operational flow of your hotel.

VeriFactu explained by Odoo or consult the official VeriFactu PR on Odoo/OCA

What happens if your PMS does not comply?

Hotels that continue to operate with non-adapted software:

- They could be fined up to €50,000 per fiscal year.

- They will not be able to justify their invoicing to the tax authorities in the event of an inspection.

- They will be forced to migrate in an urgent and unplanned manner.

What if you already use Roomdoo?

Good news: you don't have to do anything.

- Your system is already VeriFactu compliant.

- We closely monitor all Odoo developments to ensure tax compliance.

- You can issue invoices with peace of mind, knowing that your PMS complies with the law.

Why choose Roomdoo for your hotel?

- PMS based on Odoo, always up to date.

- Compatible with VeriFactu.

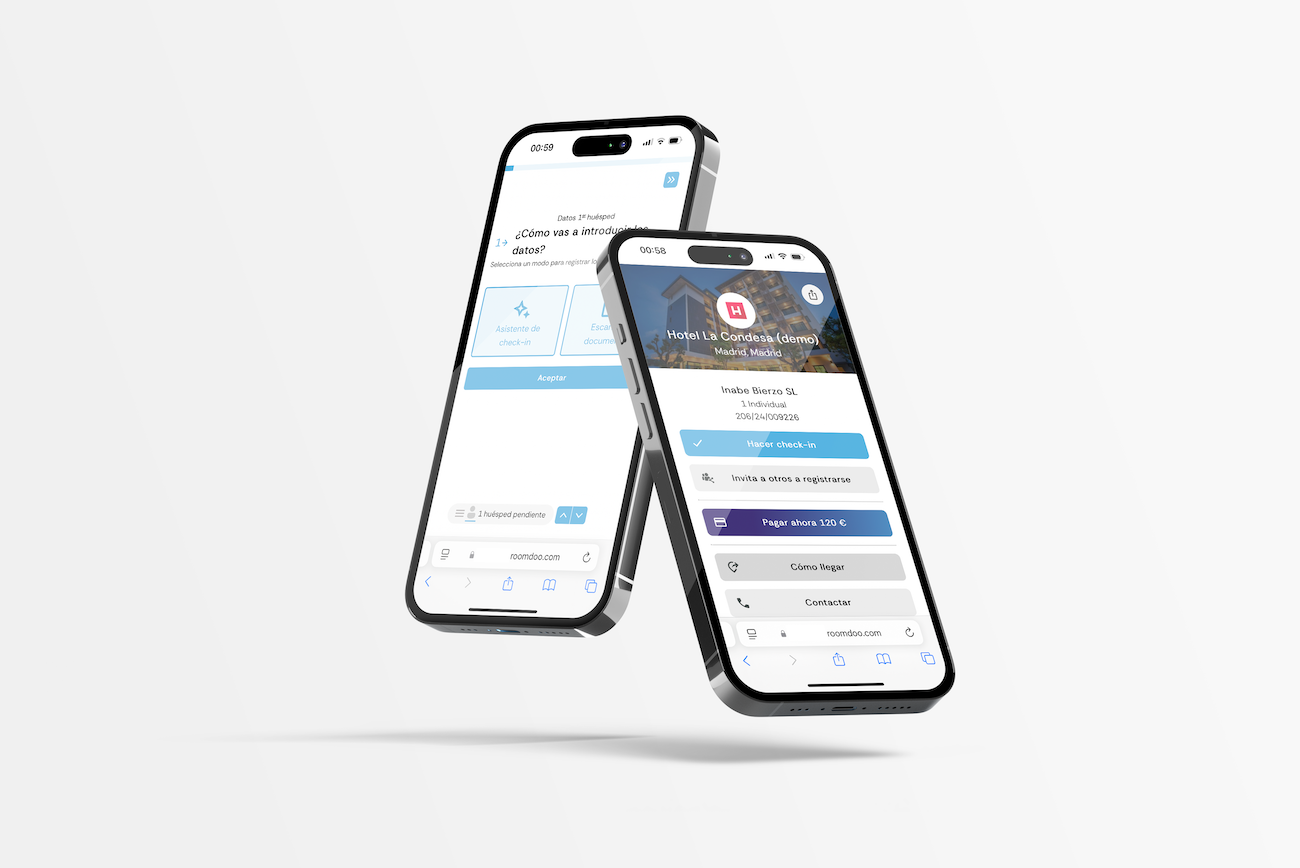

- Automatically integrated with SES.Hospedajes.

- Invoicing, reservations, check-in, accounting and more in a single platform.

- Easy migration from your current PMS.

- Technical support specialized in the hotel sector.

Want to check if your PMS software is VERI*FACTU compliant?

- Does it include QR, hashing, traceability?

- Is it adapted to the Ministerial Order HAC/1177/2024?

- Can you send the data to the IRS?

We solve it in 5 minutes, contact us with your inquiry.

- If you don't know or are not sure, ask now.

- If you don't comply, start planning for change.

Links of interest:

🔗 Official source - AEAT Compilation of questions and answers regarding the Computerized Invoicing Systems and VERI*FACTU